by RSM US LLP | Mar 27, 2024

< Back to the Insights Gallery Transform your business with finance automationARTICLE | March 27, 2024Authored by RSM US LLPFinance and accounting are essential aspects of every business, but they’re historically reliant on time-consuming and error-prone manual...

by RSM US LLP | Mar 25, 2024

< Back to the Insights Gallery Credits and incentives available to retirement plan sponsorsARTICLE | March 25, 2024Authored by RSM US LLPExecutive summary: Credits for retirement plan sponsorsContinued concerns by congressional leaders for employees to attain...

by RSM US LLP | Mar 21, 2024

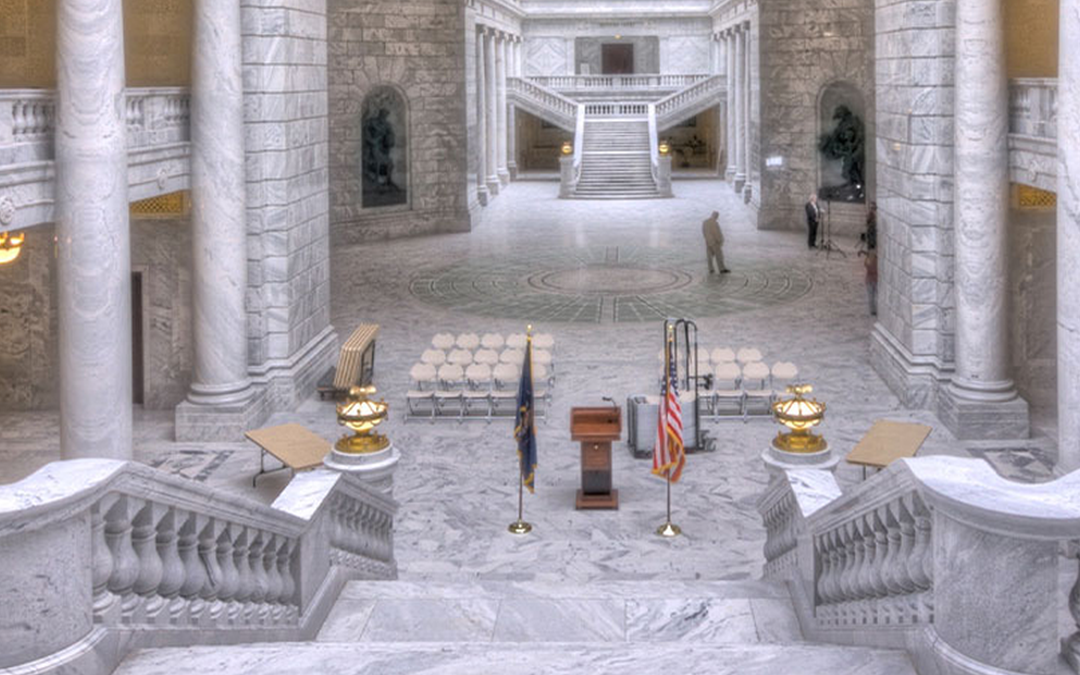

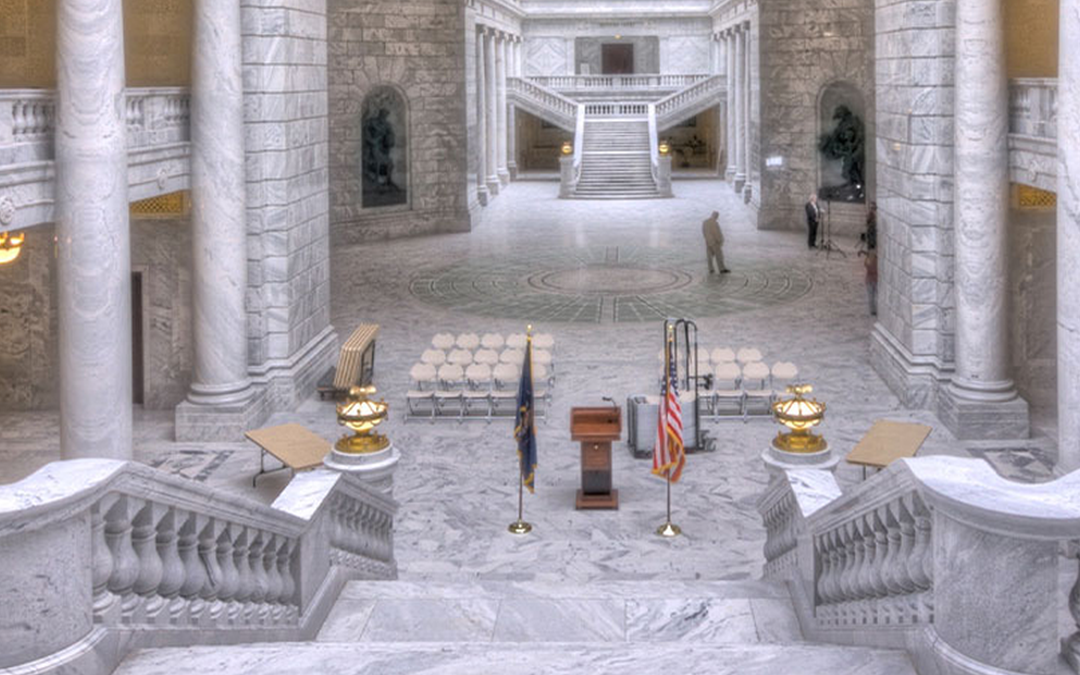

< Back to the Insights Gallery Fiscal year 2025 budget proposal contains items affecting exempt organizationsARTICLE | March 21, 2024Authored by RSM US LLPExecutive summary: Budget proposal again includes items affecting certain exempt organizationsThe Biden...

by RSM US LLP | Mar 7, 2024

< Back to the Insights Gallery IRS announces increased audit activity for personal usage of corporate planesARTICLE | March 07, 2024Authored by RSM US LLPExecutive summary:The IRS announced that it will begin audit activity relating to business aircraft that are...

by RSM US LLP | Mar 7, 2024

< Back to the Insights Gallery IRS announces new initiative aimed at high-income non-filersARTICLE | March 07, 2024Authored by RSM US LLPExecutive summaryIRS announces new initiative directed at high-income earners who have not filed prior year tax returns. IRS has...