by RSM US LLP | Dec 21, 2023

< Back to the Insights Gallery IRS to provide automatic penalty relief to eligible taxpayersARTICLE | December 21, 2023Authored by RSM US LLPExecutive summaryThe IRS announced plans to provide automatic penalty relief for failure to pay penalties incurred in tax...

by RSM US LLP | Dec 8, 2023

< Back to the Insights Gallery IRS will use AI to help target partnerships and high net worth individualsARTICLE | December 08, 2023Authored by RSM US LLPExecutive summary: IRS to target large partnerships and wealthy individualsLarge partnerships and high net...

by RSM US LLP | Dec 1, 2023

< Back to the Insights Gallery Tax Court rules state law limited partner may be subject to self-employment taxARTICLE | December 01, 2023Authored by RSM US LLPExecutive summary: Limited partner exception from self-employment taxIn ruling on a motion for partial...

by RSM US LLP | Nov 29, 2023

< Back to the Insights Gallery IRS delays implementation of lower $600 reporting threshold for 1099-KARTICLE | November 29, 2023Authored by RSM US LLPExecutive SummaryAs 2023 comes to an end and just in time for the holidays, the IRS threw a much needed 'hail Mary’...

by RSM US LLP | Nov 17, 2023

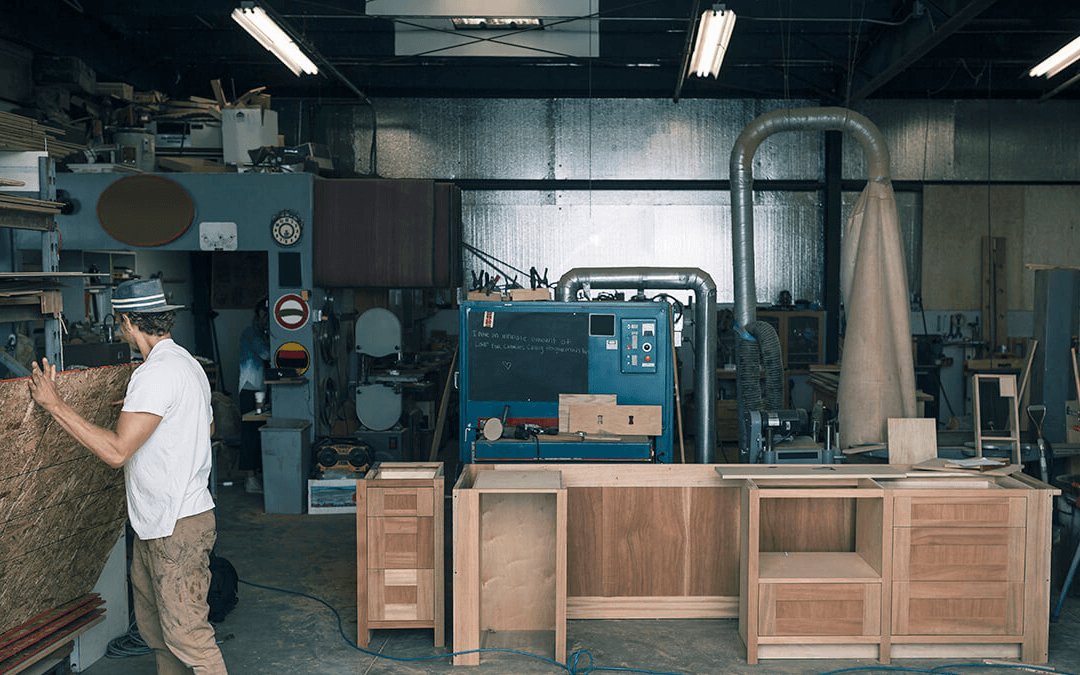

< Back to the Insights Gallery Are ESOPs a good fit for business and professional services (BPS) companies?ARTICLE | November 17, 2023Authored by RSM US LLPExecutive summary: ESOPs in the BPS industryEmployee stock ownership plans (ESOPs) can be advantageous for a...