Insights Gallery

Content Type:

Industry:

Service:

- All

- Audit

- Business Applications

- Business Strategy

- Business Tax

- Compensation and Benefits

- Cybersecurity Risk

- Digital Transformation

- Family Office Services

- Federal Tax

- Financial Consulting

- Financial Management

- International Tax Planning

- Managed Services

- Managed Technology Services

- Management Consulting

- Mergers & Acquisition

- Private Client

- Private Client Services

- Regulatory Compliance

- Risk Consulting

- Tax

Topic:

- All

- AICPA Matters

- Artificial Intelligence

- Automation

- CECL

- Covid-19

- Cryptocurrency

- Cybersecurity

- Digital Assets

- Digital Evolution

- Economics

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Inflation

- International Standards

- Labor and Workforce

- Lease Accounting

- PCAOB Matters

- Policy

- Regulations and Compliance

- SEC Matters

- State Tax Nexus

- Supply Chain

- Tax Reform

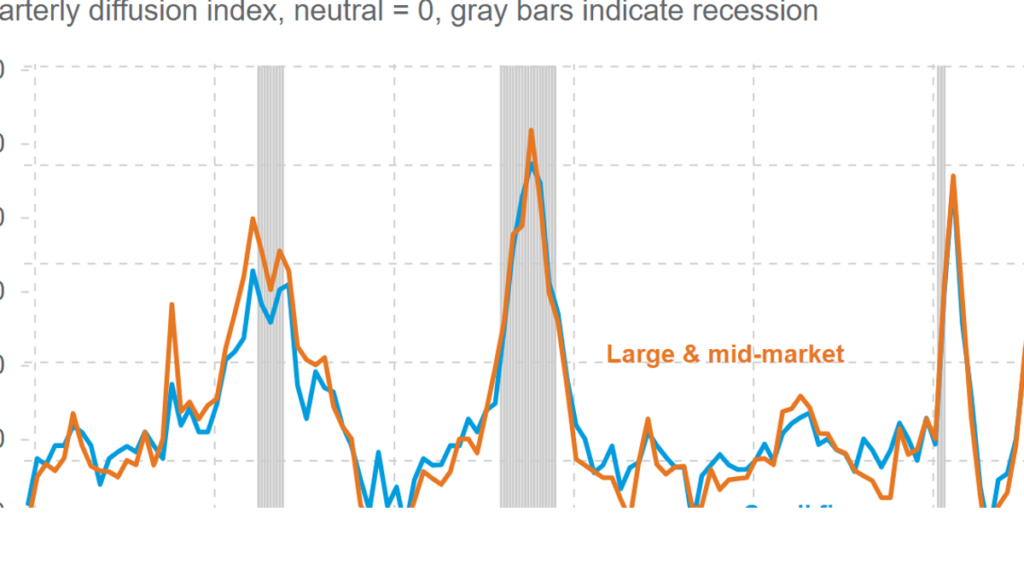

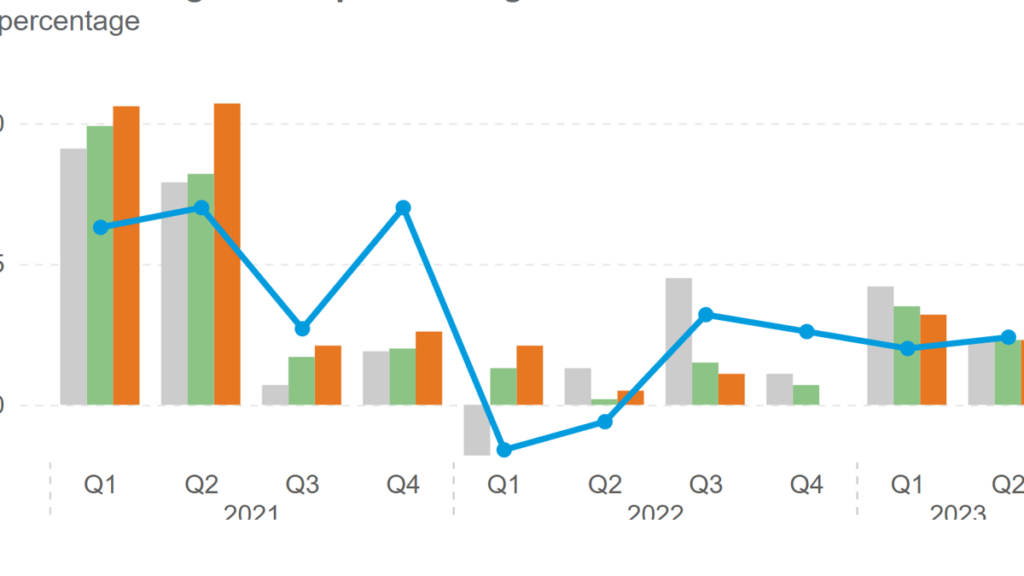

Fed survey of loan officers shows rising impact of higher interest rates

The Federal Reserve's latest survey of bank lending officers confirms that the dampening effect of monetary-policy tightening on borrowing and lending continued in the second quarter.

FedNow set to modernize nation’s payment system

In addition to real-time settlement, FedNow is expected to offer several benefits to both businesses and consumers seeking better options for managing their finances.

Private foundation do’s and don’ts: Common self-dealing issues

Private foundations generally may not engage in transactions with disqualified persons, even under terms that are favorable to the private foundation.

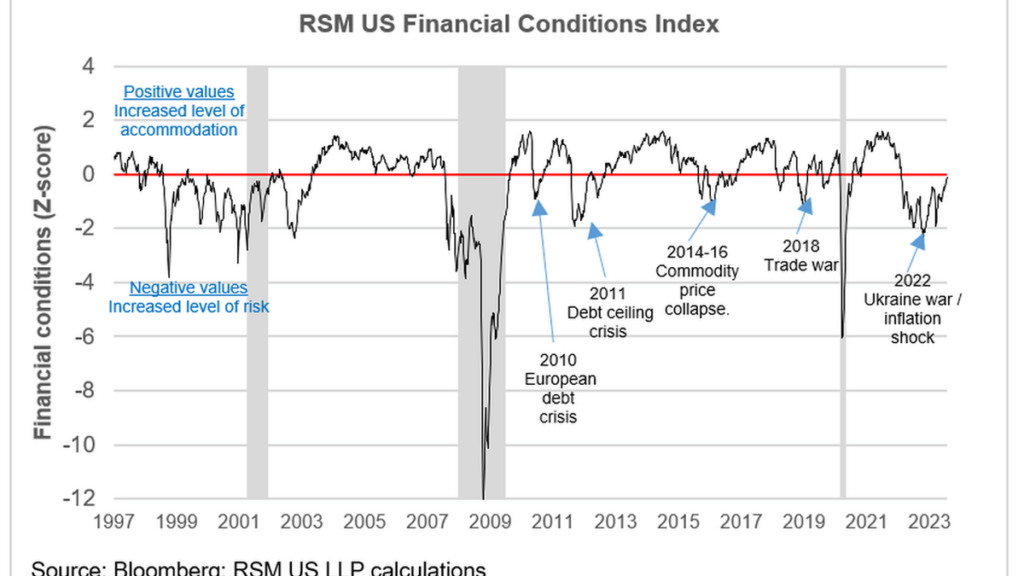

RSM US Financial Conditions Index moving toward neutral

With the money market at normal levels of risk, and with surging equities balancing out the caution displayed in the bond market continues to price in the possibility of a recession.

U.S. charitable donations fell last year

Donations to charity fell to $499 billion last year, a 3.4% decrease from 2021.

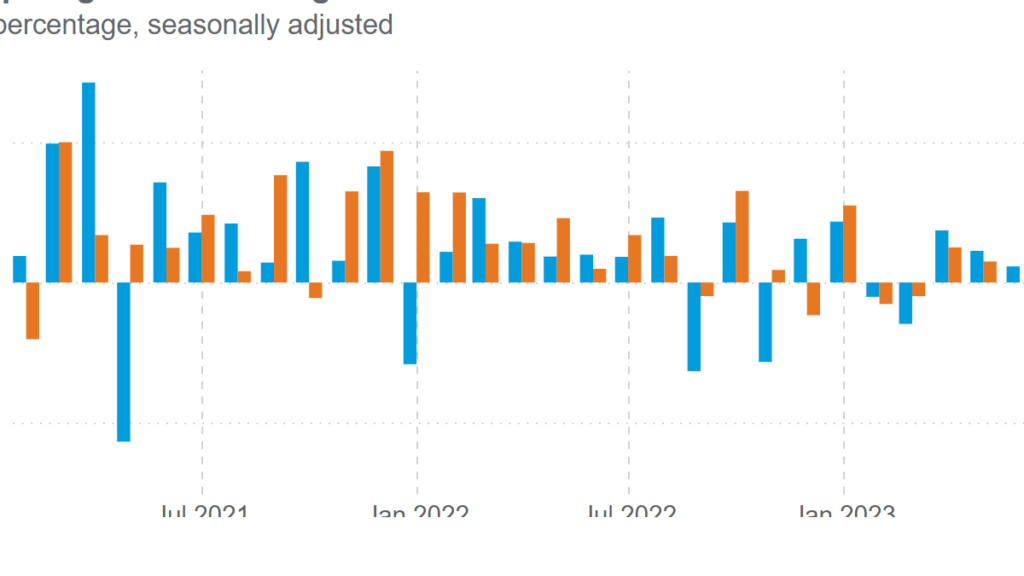

Business orders for equipment rise despite higher borrowing costs

New orders for core capital goods, a proxy for business investment, came in higher than forecast in June, rising by 0.2%, the Commerce Department reported on Thursday.

Resilience defined as American economy continues to defy expectations

Driven by the household consumption, the American economy expanded at a 2.4% seasonally adjusted annualized rate.

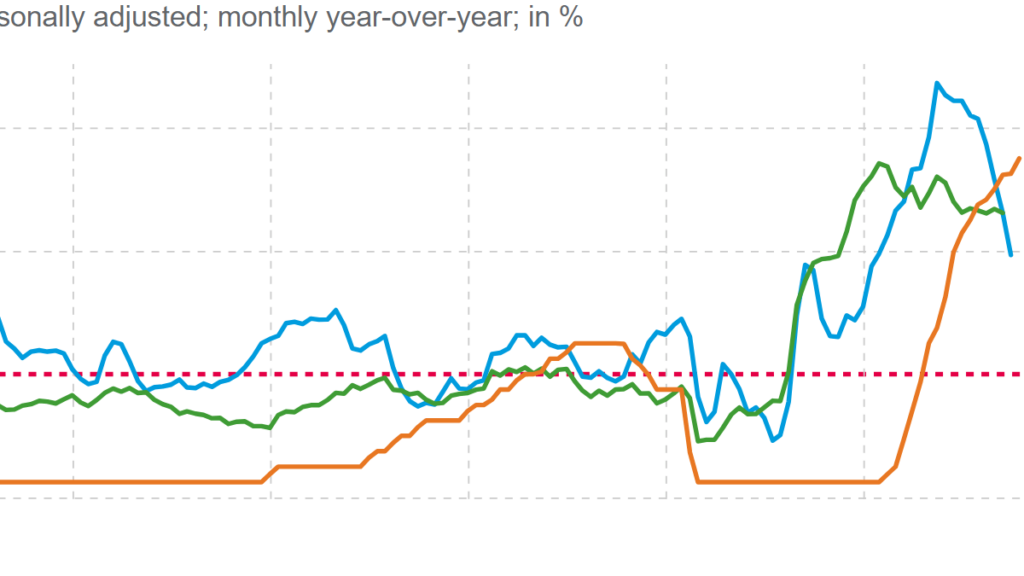

FOMC policy decision: The time for an end to rate hikes has arrived

With the policy rate standing above two closely watched measures of inflation, it is now time for the Federal Reserve to allow the economy an extended period.

IRS provides guidance for required minimum distributions for SECURE 2.0 Act

Notice 2023-54 provides transition relief and guidance relating to certain required minimum distributions based on SECURE 2.0 changes.

IRS clarifies employee retention credit guidance

IRS guidance addresses full or partial suspensions of operations due to supply chain disruption for ERTC and erroneous ERTC refunds.

Tax Court once again denies related party bad debt deduction

Proper documentation of related party cash advances is imperative if a taxpayer intends to substantiate the advances as debt for tax purposes.

The road to financial transformation

Review RSM's finance function assessment to illuminate specific actions to achieve accounting and finance process optimization.

Monday - Friday: 8:00 AM - 5:00 PM

*Friday hours are 8:00 AM – Noon between Memorial Day and Labor Day

Closed Saturday & Sunday

Subscribe to Our Newsletter

Johnson & Sheldon, PLLC

Amarillo Location

500 S Taylor St Suite 200

Amarillo, TX 79101

Phone: 806-371-7661

Fax: 806-371-0529

Email: ebaten@amacpas.com

Johnson & Sheldon, PLLC

Pampa Location

2004 N. Hobart

Pampa, TX 79065

Phone: 806-665-8429

Fax: 806-665-8804

Email: fbeavers@amacpas.com

Johnson & Sheldon, PLLC

Hereford Location

119 E 4th St

Hereford TX 79045

Phone: 806-364-4686

Fax: 806-364-0826

Email: khollingsworth@amacpas.com