Insights Gallery

Content Type:

Industry:

Service:

- All

- Audit

- Business Applications

- Business Strategy

- Business Tax

- Compensation and Benefits

- Cybersecurity Risk

- Digital Transformation

- Family Office Services

- Federal Tax

- Financial Consulting

- Financial Management

- International Tax Planning

- Managed Services

- Managed Technology Services

- Management Consulting

- Mergers & Acquisition

- Private Client

- Private Client Services

- Regulatory Compliance

- Risk Consulting

- Tax

Topic:

- All

- AICPA Matters

- Artificial Intelligence

- Automation

- CECL

- Covid-19

- Cryptocurrency

- Cybersecurity

- Digital Assets

- Digital Evolution

- Economics

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Inflation

- International Standards

- Labor and Workforce

- Lease Accounting

- PCAOB Matters

- Policy

- Regulations and Compliance

- SEC Matters

- State Tax Nexus

- Supply Chain

- Tax Reform

The 3 pillars of artificial intelligence: How AI will reshape business and the economy

Generative AI and the coming productivity boom

How companies can create and capture value from generative AI

The essential guide to estate planning and income taxes

OCC issues 2023 edition of “Bank Accounting Advisory Series”

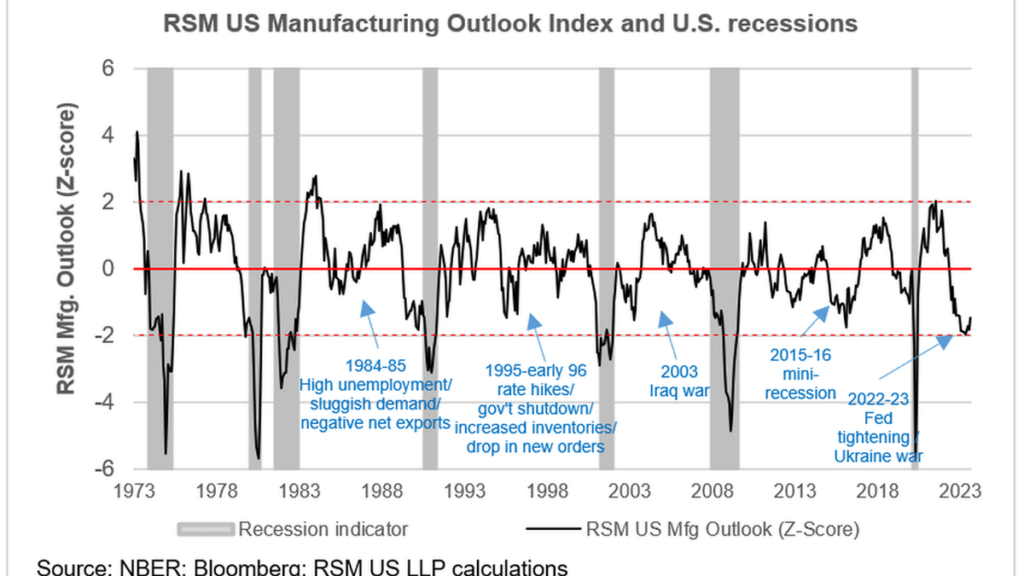

RSM US Manufacturing Outlook Index: Signs of a bottom

Job openings drop to lowest in more than two years

For boards, the best cybersecurity defense is a good offense

Your path to a quality auditor

Industrial production and housing rebound in July, affirming GDP growth outlook

Driving change: The new era of logistics and distribution

Family offices emerge as real estate investment power players

Monday - Friday: 8:00 AM - 5:00 PM

*Friday hours are 8:00 AM – Noon between Memorial Day and Labor Day

Closed Saturday & Sunday

Subscribe to Our Newsletter

Johnson & Sheldon, PLLC

Amarillo Location

500 S Taylor St Suite 200

Amarillo, TX 79101

Phone: 806-371-7661

Fax: 806-371-0529

Email: ebaten@amacpas.com

Johnson & Sheldon, PLLC

Pampa Location

2004 N. Hobart

Pampa, TX 79065

Phone: 806-665-8429

Fax: 806-665-8804

Email: fbeavers@amacpas.com

Johnson & Sheldon, PLLC

Hereford Location

119 E 4th St

Hereford TX 79045

Phone: 806-364-4686

Fax: 806-364-0826

Email: khollingsworth@amacpas.com

We are clients of the RSM Professional Services+ Practice. As a client, we have access to the Professional Services+ Collaborative, a globally connected community that provides access to an ecosystem of capabilities, collaboration and camaraderie to help professional services firms grow and thrive in a rapidly changing business environment. As a participant in the PS+ Collaborative, we have the opportunity to interact and share best practices with other professional services firms across the U.S. and Canada.