Insights Gallery

Content Type:

Industry:

Service:

- All

- Audit

- Business Applications

- Business Strategy

- Business Tax

- Compensation and Benefits

- Cybersecurity Risk

- Digital Transformation

- Family Office Services

- Federal Tax

- Financial Consulting

- Financial Management

- International Tax Planning

- Managed Services

- Managed Technology Services

- Management Consulting

- Mergers & Acquisition

- Private Client

- Private Client Services

- Regulatory Compliance

- Risk Consulting

- Tax

Topic:

- All

- AICPA Matters

- Artificial Intelligence

- Automation

- CECL

- Covid-19

- Cryptocurrency

- Cybersecurity

- Digital Assets

- Digital Evolution

- Economics

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Inflation

- International Standards

- Labor and Workforce

- Lease Accounting

- PCAOB Matters

- Policy

- Regulations and Compliance

- SEC Matters

- State Tax Nexus

- Supply Chain

- Tax Reform

The essential guide to estate planning and income taxes

Avoiding unintended income tax consequences in your estate plan.

OCC issues 2023 edition of “Bank Accounting Advisory Series”

This edition was updated to add new guidance on loan modifications, reflect the adoption of the CECL and leases standards, and more.

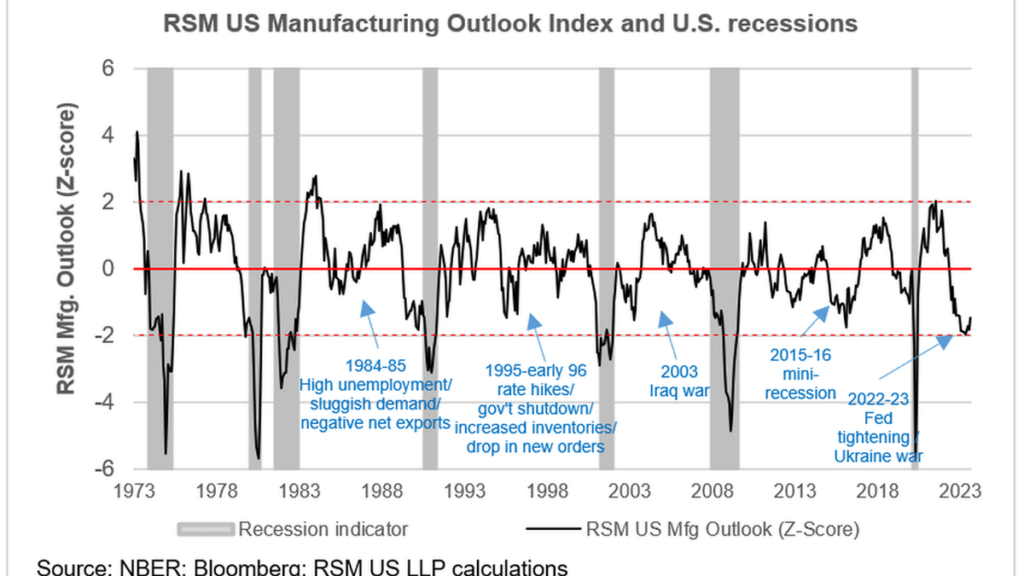

RSM US Manufacturing Outlook Index: Signs of a bottom

Only two of the five manufacturing centers surveyed by regional Federal Reserve banks, New York and Dallas, reported substantial declines Philadelphia and Kansas City regions reported substantial increases, while Richmond had a slight increase.

Job openings drop to lowest in more than two years

Job openings fell to 8.8 million in July, staying under 9 million for the first time since March 2021, according to the Bureau of Labor Statistics on Tuesday.

For boards, the best cybersecurity defense is a good offense

The regulation has been introduced to improve transparency in the markets for sustainable investment products while increasing transparency around sustainability claims made by FMPs.

Your path to a quality auditor

As your business grows and becomes more complex, your audit needs evolve. You might feel an increasing need for industry specificity, or perhaps your data management challenges demand modern applications and processes.

Industrial production and housing rebound in July, affirming GDP growth outlook

Industrial production, housing starts and permits rebounded in July, affirming RSM US LLP's economic growth outlook for the third quarter.

Driving change: The new era of logistics and distribution

Logistics and distribution companies that prioritize digital transformation will be able to tap into enormous opportunities. Companies need to examine where there are opportunities to standardize and streamline operations across the business and how advanced technologies can help improve processes, attract and retain talent, and enhance customer visibility.

Family offices emerge as real estate investment power players

Family offices emerge as real estate investment power players as institutional investors pull back amid continued uncertainty.

Construction project demand heightens need for “contech” adoption strategies

For the construction industry, the need for contech adoption will continue to increase amid an influx of projects and skilled labor shortage.

Safeguard your legacy by avoiding these 8 estate planning pitfalls

Estate planning tips to help you avoid common pitfalls and safeguard your wealth and legacy.

How Top CEOs Found Success Through Immersion

Discover how CEOs of Airbnb, Starbucks, and Uber immersed themselves in their own businesses as customers and frontline employees, gaining valuable insights that transformed their companies. Learn how their firsthand experiences led to innovative improvements and a better understanding of their customers' needs.

Monday - Friday: 8:00 AM - 5:00 PM

*Friday hours are 8:00 AM – Noon between Memorial Day and Labor Day

Closed Saturday & Sunday

Subscribe to Our Newsletter

Johnson & Sheldon, PLLC

Amarillo Location

500 S Taylor St Suite 200

Amarillo, TX 79101

Phone: 806-371-7661

Fax: 806-371-0529

Email: ebaten@amacpas.com

Johnson & Sheldon, PLLC

Pampa Location

2004 N. Hobart

Pampa, TX 79065

Phone: 806-665-8429

Fax: 806-665-8804

Email: fbeavers@amacpas.com

Johnson & Sheldon, PLLC

Hereford Location

119 E 4th St

Hereford TX 79045

Phone: 806-364-4686

Fax: 806-364-0826

Email: khollingsworth@amacpas.com