Insights Gallery

Content Type:

Industry:

Service:

- All

- Audit

- Business Applications

- Business Strategy

- Business Tax

- Compensation and Benefits

- Cybersecurity Risk

- Digital Transformation

- Family Office Services

- Federal Tax

- Financial Consulting

- Financial Management

- International Tax Planning

- Managed Services

- Managed Technology Services

- Management Consulting

- Mergers & Acquisition

- Private Client

- Private Client Services

- Regulatory Compliance

- Risk Consulting

- Tax

Topic:

- All

- AICPA Matters

- Artificial Intelligence

- Automation

- CECL

- Covid-19

- Cryptocurrency

- Cybersecurity

- Digital Assets

- Digital Evolution

- Economics

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Inflation

- International Standards

- Labor and Workforce

- Lease Accounting

- PCAOB Matters

- Policy

- Regulations and Compliance

- SEC Matters

- State Tax Nexus

- Supply Chain

- Tax Reform

ESG explained: What companies need to know

Environmental, social, and governance is now a key success factor for many companies. Learn more about ESG's potential issues, risks, and opportunities.

RSM again calls on Congress to address problematic changes to R&D tax law

RSM has submitted a second comment letter to Congress addressing the requirement to capitalize and amortize R&D expenditures under section 174.

FASB votes to simplify accounting for common control leases

For common control leases, the FASB is drafting amendments to simplify determining whether a lease exists, the classification of the lease, and accounting for leasehold improvements.

Proposed regulations on using forfeitures in retirement plans

Proposed regulations REG-122286-18, released Feb. 24, provide guidelines for plan administrators to use forfeited amounts in retirement plans.

Properly Funding Your Living Trust

Failing to properly fund a living trust is one of the most common errors people make and can lead to unintended consequences and added costs for both the individual and their beneficiaries. In this video, we'll provide an overview of how to properly fund a living trust.

R&E Expense Amortization Got You Down?

Now that Research & Experimentation expenses must be amortized over several years, many companies are looking for ways to increase deductions and reduce taxable income. Here are three opportunities to potentially accelerate depreciation and reduce your tax liability.

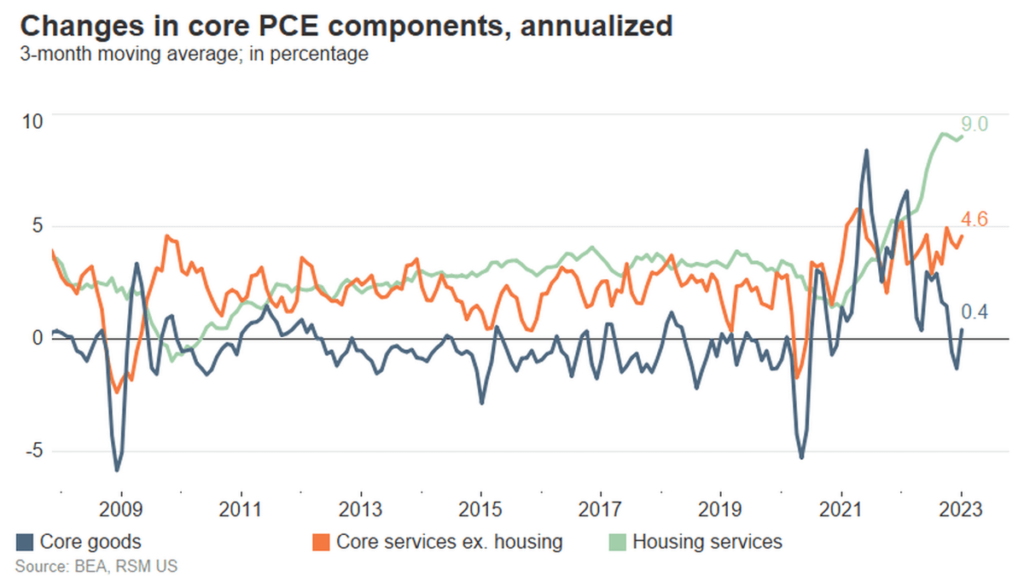

RSM revises its Fed call as inflation proves sticky

We now expect at least three 25 basis-point hikes at the Fed's March, May and June policy meetings with the risk of a 50 basis-point hike in March.

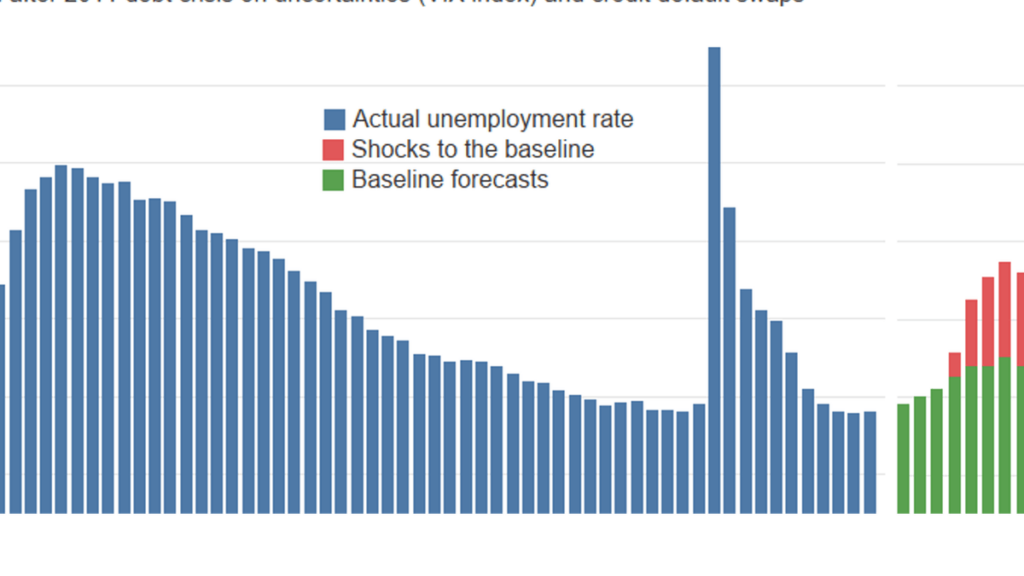

What would happen if the government defaults on its debt?

Policy brinksmanship over lifting the debt ceiling and the threat of default it brings is increasing the cost of doing business and carries far more risk than is commonly acknowledged.

Retirement plan changes for long-term, part-time employees

SECURE 2.0 changes the rules for how long-term, part-time employees are treated for purposes of 401(k) and 403(b) retirement plans.

Required minimum distributions after SECURE 2.0

SECURE 2.0 changes the rules governing how and when certain retirement savers can withdraw money from their retirement accounts and IRAs.

South Dakota drops Wayfair transaction threshold

First state to adopt economic sales tax nexus eliminates 200-transaction threshold providing remote sellers more certainty in determining nexus.

Making audit make sense

For too many boards, the audit committee remains a catch-all for issues that don't seem to fit elsewhere. A roundtable discussion.

Monday - Friday: 8:00 AM - 5:00 PM

*Friday hours are 8:00 AM – Noon between Memorial Day and Labor Day

Closed Saturday & Sunday

Subscribe to Our Newsletter

Johnson & Sheldon, PLLC

Amarillo Location

500 S Taylor St Suite 200

Amarillo, TX 79101

Phone: 806-371-7661

Fax: 806-371-0529

Email: ebaten@amacpas.com

Johnson & Sheldon, PLLC

Pampa Location

2004 N. Hobart

Pampa, TX 79065

Phone: 806-665-8429

Fax: 806-665-8804

Email: fbeavers@amacpas.com

Johnson & Sheldon, PLLC

Hereford Location

119 E 4th St

Hereford TX 79045

Phone: 806-364-4686

Fax: 806-364-0826

Email: khollingsworth@amacpas.com