Insights Gallery

Content Type:

Industry:

Service:

- All

- Audit

- Business Applications

- Business Strategy

- Business Tax

- Compensation and Benefits

- Cybersecurity Risk

- Digital Transformation

- Family Office Services

- Federal Tax

- Financial Consulting

- Financial Management

- International Tax Planning

- Managed Services

- Managed Technology Services

- Management Consulting

- Mergers & Acquisition

- Private Client

- Private Client Services

- Regulatory Compliance

- Risk Consulting

- Tax

Topic:

- All

- AICPA Matters

- Artificial Intelligence

- Automation

- CECL

- Covid-19

- Cryptocurrency

- Cybersecurity

- Digital Assets

- Digital Evolution

- Economics

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Inflation

- International Standards

- Labor and Workforce

- Lease Accounting

- PCAOB Matters

- Policy

- Regulations and Compliance

- SEC Matters

- State Tax Nexus

- Supply Chain

- Tax Reform

South Dakota drops Wayfair transaction threshold

Making audit make sense

Business ownership: The dynamics of a mature business

Business ownership: A focus on growth

Business ownership: Startup challenges and opportunities

Business ownership: Business transition

Business ownership: Launch with confidence

Protecting Your Finances During an Economic Downturn

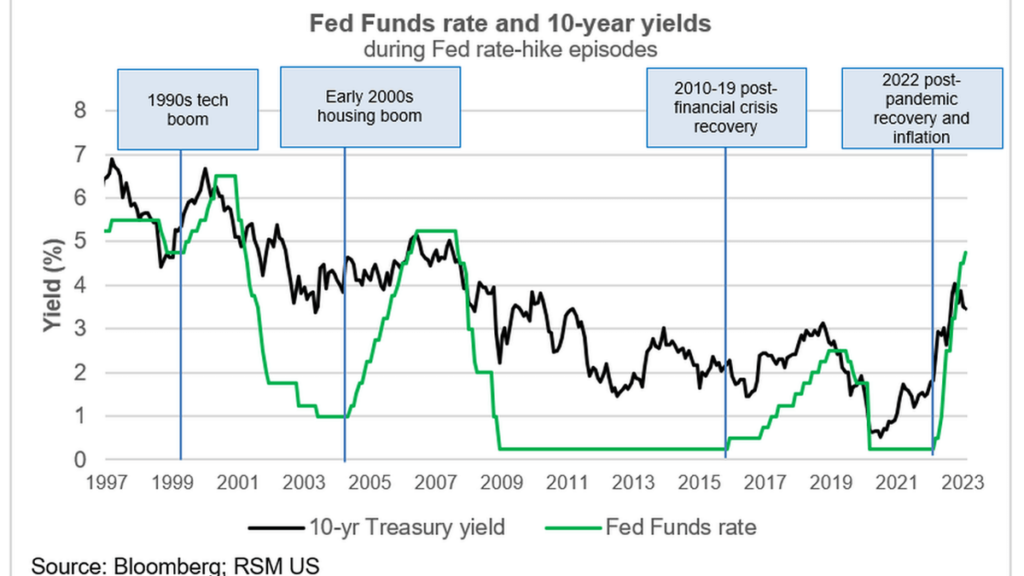

Fed hikes rates by 25 basis points as it approaches peak

FOMC preview: Fed to slow pace of rate hikes to 25 basis points

Incentivize Employees With Stock Appreciation Rights Instead of Equity

A guide to business ownership

Monday - Friday: 8:00 AM - 5:00 PM

*Friday hours are 8:00 AM – Noon between Memorial Day and Labor Day

Closed Saturday & Sunday

Subscribe to Our Newsletter

Johnson & Sheldon, PLLC

Amarillo Location

500 S Taylor St Suite 200

Amarillo, TX 79101

Phone: 806-371-7661

Fax: 806-371-0529

Email: ebaten@amacpas.com

Johnson & Sheldon, PLLC

Pampa Location

2004 N. Hobart

Pampa, TX 79065

Phone: 806-665-8429

Fax: 806-665-8804

Email: fbeavers@amacpas.com

Johnson & Sheldon, PLLC

Hereford Location

119 E 4th St

Hereford TX 79045

Phone: 806-364-4686

Fax: 806-364-0826

Email: khollingsworth@amacpas.com

We are clients of the RSM Professional Services+ Practice. As a client, we have access to the Professional Services+ Collaborative, a globally connected community that provides access to an ecosystem of capabilities, collaboration and camaraderie to help professional services firms grow and thrive in a rapidly changing business environment. As a participant in the PS+ Collaborative, we have the opportunity to interact and share best practices with other professional services firms across the U.S. and Canada.