Insights Gallery

Content Type:

Industry:

Service:

- All

- Audit

- Business Applications

- Business Strategy

- Business Tax

- Compensation and Benefits

- Cybersecurity Risk

- Digital Transformation

- Family Office Services

- Federal Tax

- Financial Consulting

- Financial Management

- International Tax Planning

- Managed Services

- Managed Technology Services

- Management Consulting

- Mergers & Acquisition

- Private Client

- Private Client Services

- Regulatory Compliance

- Risk Consulting

- Tax

Topic:

- All

- AICPA Matters

- Artificial Intelligence

- Automation

- CECL

- Covid-19

- Cryptocurrency

- Cybersecurity

- Digital Assets

- Digital Evolution

- Economics

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Inflation

- International Standards

- Labor and Workforce

- Lease Accounting

- PCAOB Matters

- Policy

- Regulations and Compliance

- SEC Matters

- State Tax Nexus

- Supply Chain

- Tax Reform

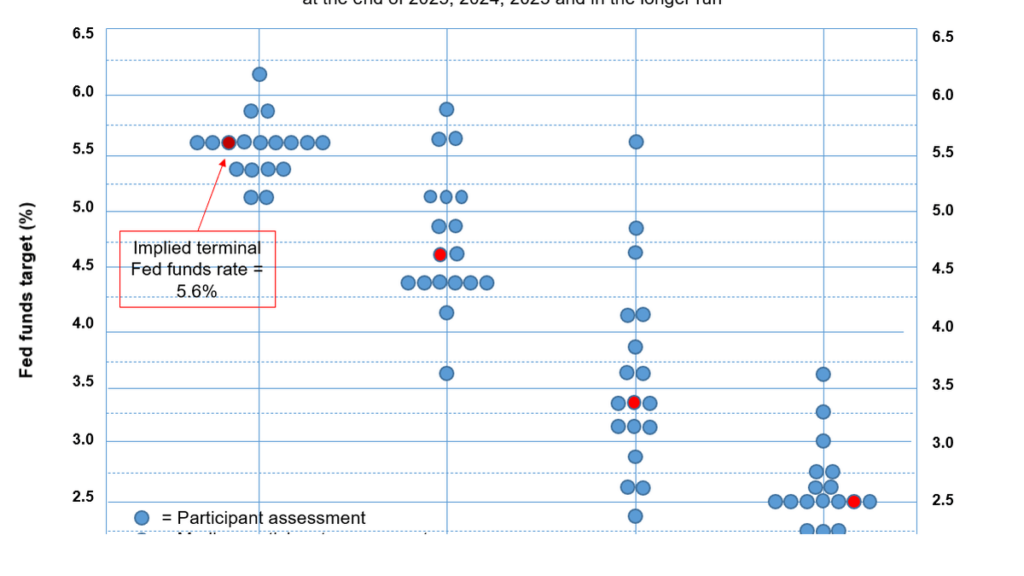

Fed pauses rate hikes while signaling a tightening bias

The Federal Open Market Committee on Wednesday kept its policy rate in a range between 5% and 5.25% while signaling that it will most likely hike the federal funds rate by 25 basis points at least twice before the end of the year.

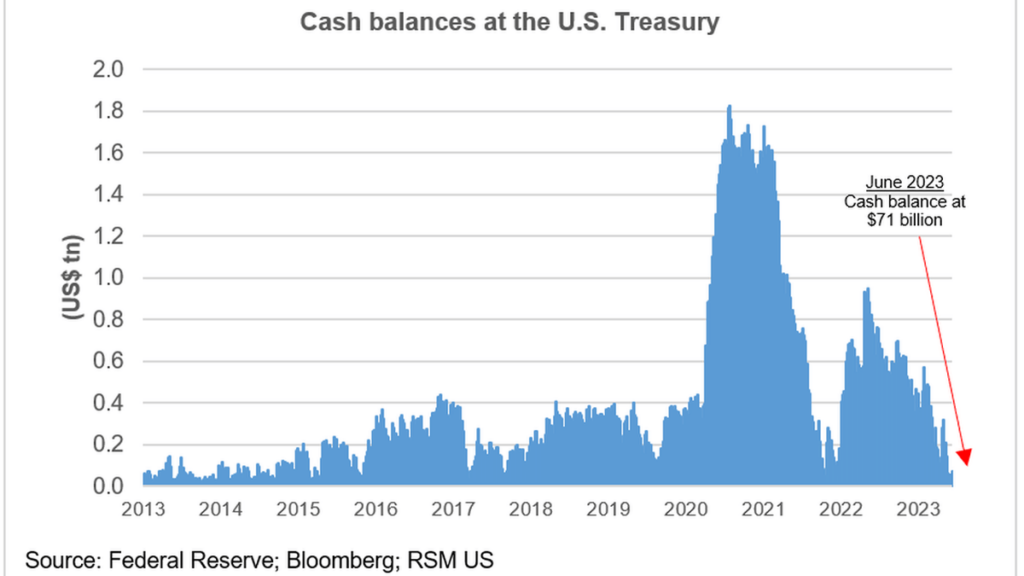

Interest rate outlook: Debt ceiling standoff raised the cost of doing business

The Treasury's need to sell $1.1 trillion in debt along with a strong probability of another Federal Reserve rate hike or two will push interest rates higher, raising the cost of doing business.

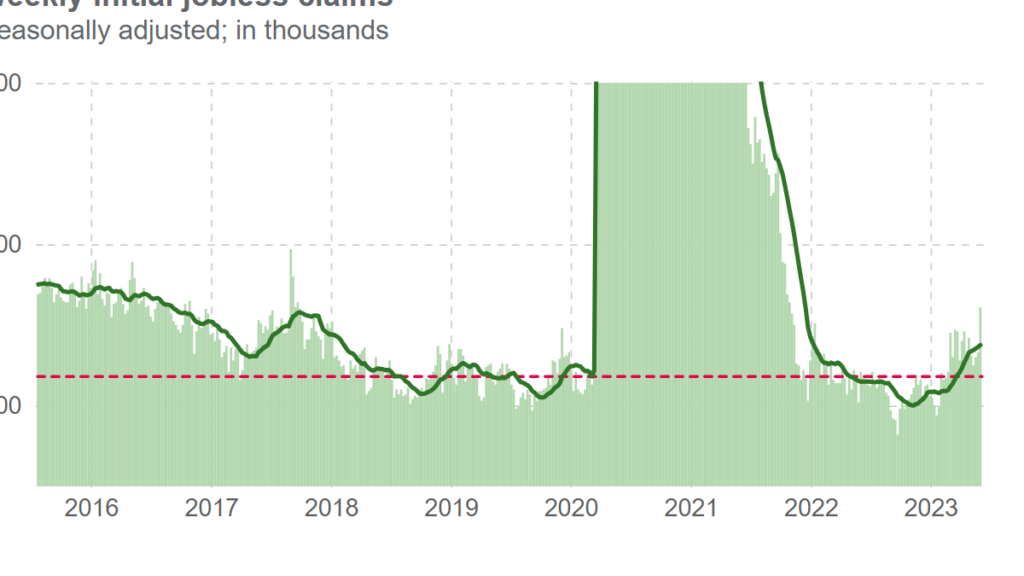

Initial jobless claims spike to highest since 2021

Total new filings for jobless benefits rose to 261,000 last week, the highest since October 2021, the Labor Department reported on Thursday.

Wayfair turns five: A coming of age story

With so many questions remaining five years after Wayfair, sales and use tax nexus planning remains critically important.

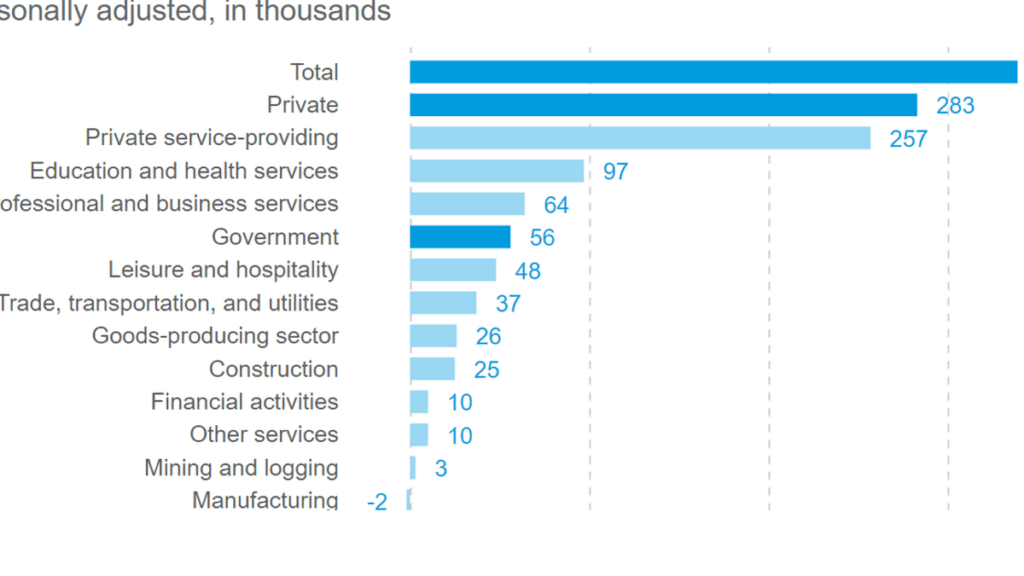

Economy added 339,000 jobs in blowout May employment report

The unemployment rate increased to 3.7% as workers rejoined the labor force.

The Power of AI: Boosting Worker Productivity

Learn how Artificial Intelligence is transforming worker productivity and its impact on businesses and the labor market.

Hiring Your Child Can Help You Save Big in Taxes

Hiring your child for your business can lead to significant tax savings by shifting income, reducing taxes, and reducing FICA and FUTA obligations. However, it's crucial to follow employment laws and withhold appropriate taxes. Learn more about the benefits and rules for hiring your child.

Job openings exceed 10 million as labor market imbalance widens

With 10.1 million job vacancies in April, the openings-to-unemployed ratio—a proxy for labor demand and supply mismatches—surged to 1.79 from 1.64 previously.

Minnesota adopts retail delivery fee

Fifty-cent delivery fee on tangible personal property deliveries is intended to increase revenues for state transportation-related expenditures.

Fitch puts U.S. on ratings watch negative

It is time for the Federal Reserve to act pre-emptively to ensure well-functioning financial markets and signal to global market participants that the /8bond rating on U.S. Treasuries will remain unchanged.

A check on tech: The rise of SOC reporting

Requests for #SOC reports are on the rise. And they're only going to grow. Read our new e-book for a road map to simplified SOC reporting.

Why your company needs multifactor authentication

Companies should use multifactor authentication as part of a layered security strategy that includes identity and access management which exceeds passwords.

Monday - Friday: 8:00 AM - 5:00 PM

*Friday hours are 8:00 AM – Noon between Memorial Day and Labor Day

Closed Saturday & Sunday

Subscribe to Our Newsletter

Johnson & Sheldon, PLLC

Amarillo Location

500 S Taylor St Suite 200

Amarillo, TX 79101

Phone: 806-371-7661

Fax: 806-371-0529

Email: ebaten@amacpas.com

Johnson & Sheldon, PLLC

Pampa Location

2004 N. Hobart

Pampa, TX 79065

Phone: 806-665-8429

Fax: 806-665-8804

Email: fbeavers@amacpas.com

Johnson & Sheldon, PLLC

Hereford Location

119 E 4th St

Hereford TX 79045

Phone: 806-364-4686

Fax: 806-364-0826

Email: khollingsworth@amacpas.com