Insights Gallery

Content Type:

Industry:

Service:

- All

- Audit

- Business Applications

- Business Strategy

- Business Tax

- Compensation and Benefits

- Cybersecurity Risk

- Digital Transformation

- Family Office Services

- Federal Tax

- Financial Consulting

- Financial Management

- International Tax Planning

- Managed Services

- Managed Technology Services

- Management Consulting

- Mergers & Acquisition

- Private Client

- Private Client Services

- Regulatory Compliance

- Risk Consulting

- Tax

Topic:

- All

- AICPA Matters

- Artificial Intelligence

- Automation

- CECL

- Covid-19

- Cryptocurrency

- Cybersecurity

- Digital Assets

- Digital Evolution

- Economics

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Inflation

- International Standards

- Labor and Workforce

- Lease Accounting

- PCAOB Matters

- Policy

- Regulations and Compliance

- SEC Matters

- State Tax Nexus

- Supply Chain

- Tax Reform

How midsize companies can optimize finance, accounting functions as costs rise

Optimizing the finance and accounting function can help middle market companies weather the environment of rising capital costs.

IRS announces ERC Withdrawal Program

IRS announces simplified method for employers who have not yet received ERC refunds to withdraw claims that they now believe are ineligible.

Federal tax year-end considerations in 2023

RSM's 2023 year-end federal tax planning guide.

State and local tax year-end considerations in 2023

RSM's state and local tax year-end planning guide contains actions and ideas taxpayers should be thinking about.

Year-end tax planning guide for individuals

RSM's 2023 year-end tax planning guide for individuals and business owners.

How to prepare for the data-driven future

Without robust data, strategic growth is limited. These five steps help ensure you're capturing and using the right data to make strategic decisions.

5 signs your compensation and benefits packages need an overhaul

Understanding the tax implications of your compensation and benefits plans is essential if you want to avoid tax liabilities and offer packages that attract the right talent.

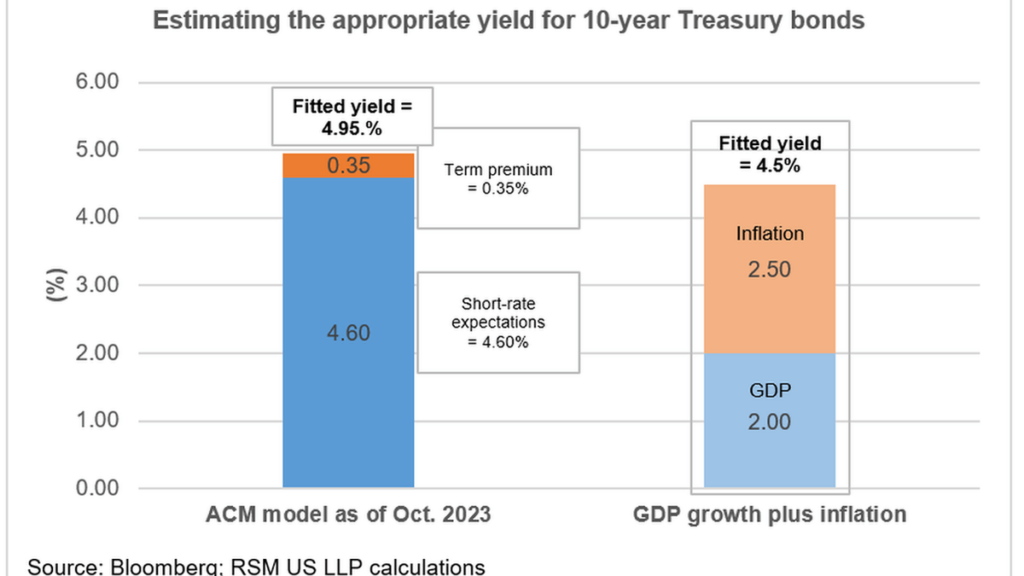

The great rate reset: The end of easy money, rising yields and the onset of a new era

For the first time in years, the risk premium has been positive, which is an important signal that interest rates are indeed returning to normal.

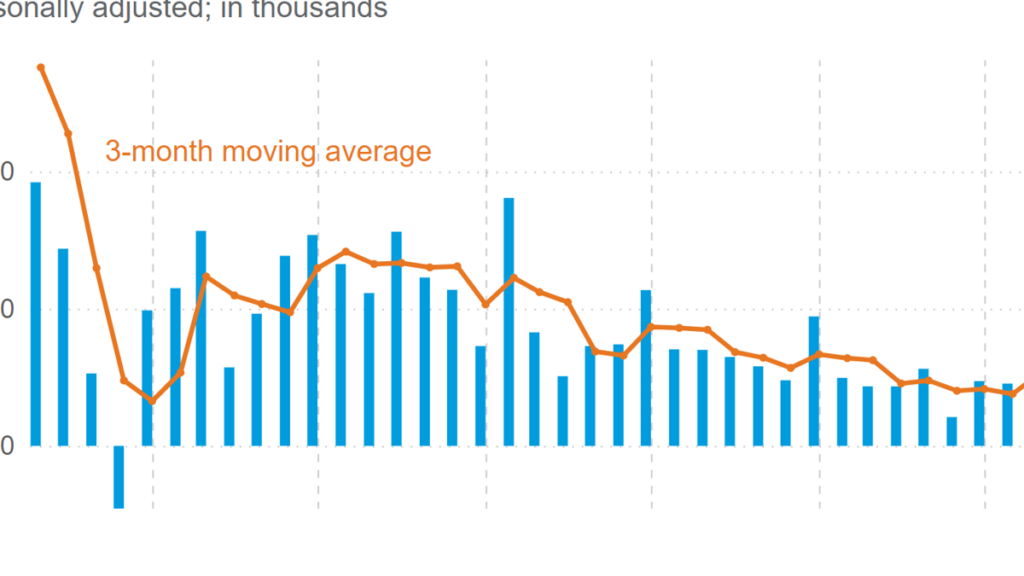

Blowout employment report is a win for the American real economy

The American economy added 336,000 jobs in September, far above forecasts and showing that the labor market has yet to ease.

Priority Guidance Plan 2023-2024

The Treasury Department and the IRS released the 2023-2024 Priority Guidance Plan, which contains a number of items affecting exempt organizations.

NLRB Decision May Affect Your Workplace Policies

Discover how a recent decision by the National Labor Relations Board could reshape workplace policies and potentially impact your business. Learn more about Section 7 of the National Labor Relations Act and the NLRB decision means for employee rights and how it could affect your company's rules.

Essential Guidelines for Owner-Involved Business Loans

Learn the important considerations when loaning money to your business or borrowing from it to avoid legal and tax issues.

Monday - Friday: 8:00 AM - 5:00 PM

*Friday hours are 8:00 AM – Noon between Memorial Day and Labor Day

Closed Saturday & Sunday

Subscribe to Our Newsletter

Johnson & Sheldon, PLLC

Amarillo Location

500 S Taylor St Suite 200

Amarillo, TX 79101

Phone: 806-371-7661

Fax: 806-371-0529

Email: ebaten@amacpas.com

Johnson & Sheldon, PLLC

Pampa Location

2004 N. Hobart

Pampa, TX 79065

Phone: 806-665-8429

Fax: 806-665-8804

Email: fbeavers@amacpas.com

Johnson & Sheldon, PLLC

Hereford Location

119 E 4th St

Hereford TX 79045

Phone: 806-364-4686

Fax: 806-364-0826

Email: khollingsworth@amacpas.com