Insights Gallery

Content Type:

Industry:

Service:

- All

- Audit

- Business Applications

- Business Strategy

- Business Tax

- Compensation and Benefits

- Cybersecurity Risk

- Digital Transformation

- Family Office Services

- Federal Tax

- Financial Consulting

- Financial Management

- International Tax Planning

- Managed Services

- Managed Technology Services

- Management Consulting

- Mergers & Acquisition

- Private Client

- Private Client Services

- Regulatory Compliance

- Risk Consulting

- Tax

Topic:

- All

- AICPA Matters

- Artificial Intelligence

- Automation

- CECL

- Covid-19

- Cryptocurrency

- Cybersecurity

- Digital Assets

- Digital Evolution

- Economics

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Inflation

- International Standards

- Labor and Workforce

- Lease Accounting

- PCAOB Matters

- Policy

- Regulations and Compliance

- SEC Matters

- State Tax Nexus

- Supply Chain

- Tax Reform

IRS will use AI to help target partnerships and high net worth individuals

The IRS announced a sweeping enforcement effort that will engage AI to focus on large partnerships and wealthy individuals.

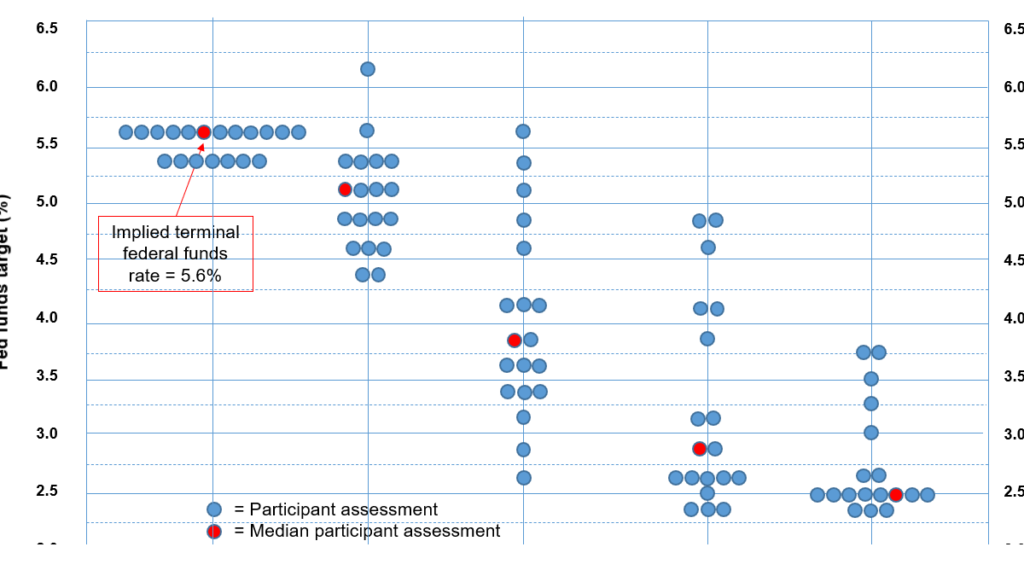

FOMC preview and the logic of Fed rate cuts in 2024

After nearly two years of raising the federal funds policy rate to restore price stability, the Federal Reserve is poised to all but declare that campaign to be over at its meeting next week.

What To Do With Old Retirement Accounts

You likely have at least one old retirement account if you've ever changed employers. These accounts stay exactly as you left them unless you take action. In this video, we'll provide options for what to do with those old accounts.

The 1031 Exchange Explained

In the world of real estate, the Section 1031 exchange has been a significant tool for investors who want to grow their real estate portfolio and wealth. In this video, we'll explain how a 1031 exchange works and important considerations when using one.

Tax Court rules state law limited partner may be subject to self-employment tax

The Tax Court ruled that holding a state law limited partnership interest is not, by itself, enough to avoid self-employment tax.

IRS delays implementation of lower $600 reporting threshold for 1099-K

New IRS notice 1099-K for small vendors will be subject to existing requirements for TY 2023, followed by a phased-in approach.

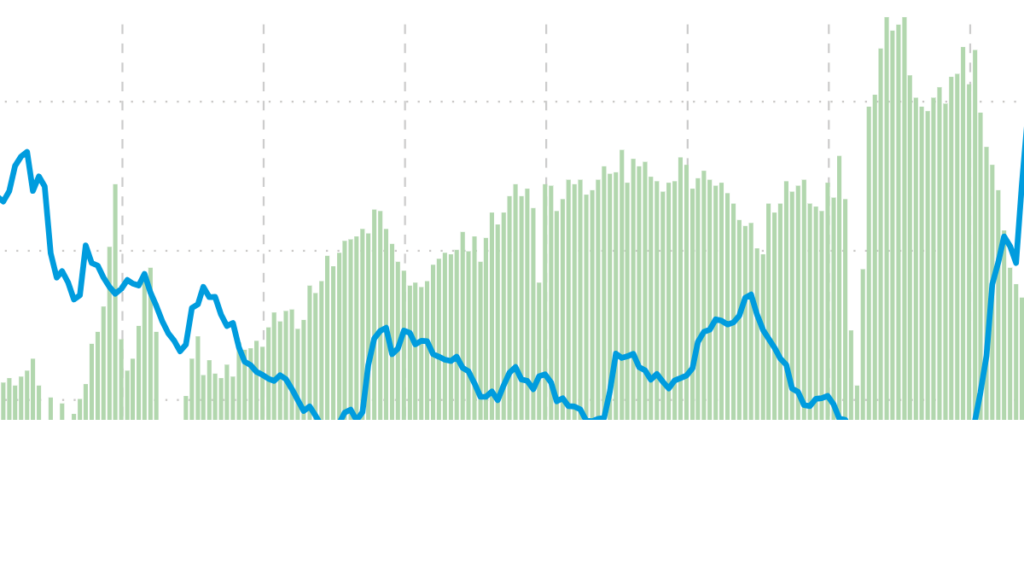

U.S. existing home sales plunged to their lowest level since 2010

In October, sales of existing homes dropped to 3.79 million, marking the lowest point since 2010, the National Realtor Association reported on Tuesday.

Are ESOPs a good fit for business and professional services (BPS) companies?

ESOPs can be advantageous to BPS companies, but their success ultimately depends on several key factors - culture, messaging and ownership goals.

IRS Releases 2024 tax inflation adjustments

IRS releases inflation adjustments for 2024. Inflation adjustments impact individual tax brackets and other various provisions of the Code.

Creating an effective enterprise growth strategy

Creating an effective enterprise growth strategy can help organizations build a foundation for future success.

How to boost employee productivity and profitability in business services

Learn how to improve employee productivity and profitability in business services by investing in development, technology, automation, outsourcing and more.

Two Estate Planning Strategies to Help Protect Wealth

A goal of estate planning is to maximize the wealth that is passed on to one's heirs. In this video, we'll discuss how a Spousal Lifetime Access Trust and an Irrevocable Life Insurance Trust may help you minimize estate taxes and protect wealth.

Monday - Friday: 8:00 AM - 5:00 PM

*Friday hours are 8:00 AM – Noon between Memorial Day and Labor Day

Closed Saturday & Sunday

Subscribe to Our Newsletter

Johnson & Sheldon, PLLC

Amarillo Location

500 S Taylor St Suite 200

Amarillo, TX 79101

Phone: 806-371-7661

Fax: 806-371-0529

Email: ebaten@amacpas.com

Johnson & Sheldon, PLLC

Pampa Location

2004 N. Hobart

Pampa, TX 79065

Phone: 806-665-8429

Fax: 806-665-8804

Email: fbeavers@amacpas.com

Johnson & Sheldon, PLLC

Hereford Location

119 E 4th St

Hereford TX 79045

Phone: 806-364-4686

Fax: 806-364-0826

Email: khollingsworth@amacpas.com