Insights Gallery

Content Type:

Industry:

Service:

- All

- Audit

- Business Applications

- Business Strategy

- Business Tax

- Compensation and Benefits

- Cybersecurity Risk

- Digital Transformation

- Family Office Services

- Federal Tax

- Financial Consulting

- Financial Management

- International Tax Planning

- Managed Services

- Managed Technology Services

- Management Consulting

- Mergers & Acquisition

- Private Client

- Private Client Services

- Regulatory Compliance

- Risk Consulting

- Tax

Topic:

- All

- AICPA Matters

- Artificial Intelligence

- Automation

- CECL

- Covid-19

- Cryptocurrency

- Cybersecurity

- Digital Assets

- Digital Evolution

- Economics

- Employee Benefit Plans

- Employee Benefits

- ESG

- Exempt Organizations

- Financial Reporting

- Inflation

- International Standards

- Labor and Workforce

- Lease Accounting

- PCAOB Matters

- Policy

- Regulations and Compliance

- SEC Matters

- State Tax Nexus

- Supply Chain

- Tax Reform

Bad debt tax deduction method proposed for financial institutions

Banks and insurance companies would see a simplification of their tax reporting of credit losses under proposed regulations.

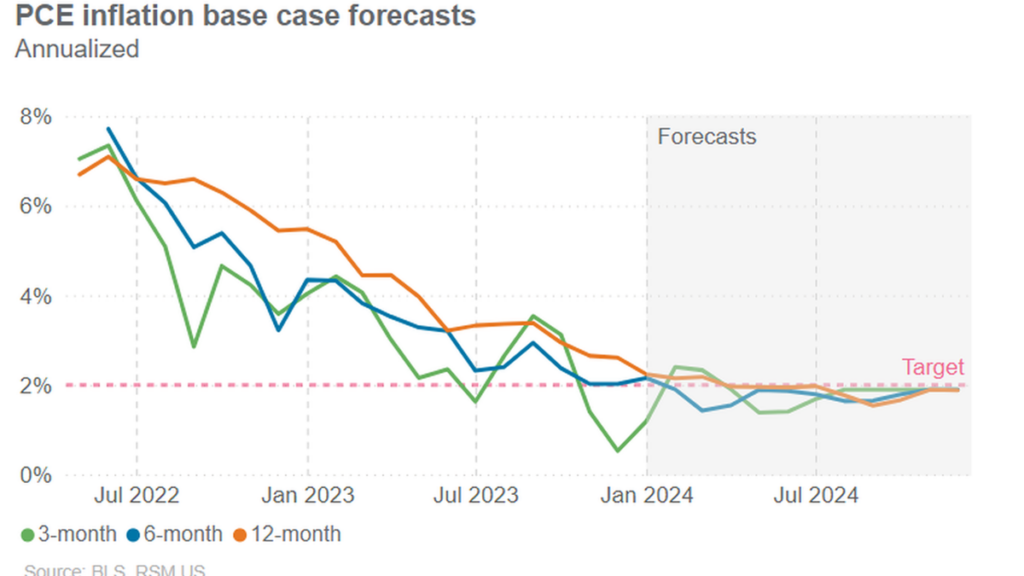

Revising our 2024 inflation outlook: Moving back to a 2% target

We expect the Fed to begin cutting rates in June, and that the central bank will reduce its policy rate four times this year, by 25 basis points each.

Tax relief bill passes House, faces uncertain fate in Senate

Tax legislation packaging the child tax credit and favorable business tax provisions moves to the Senate with momentum but an uncertain fate.

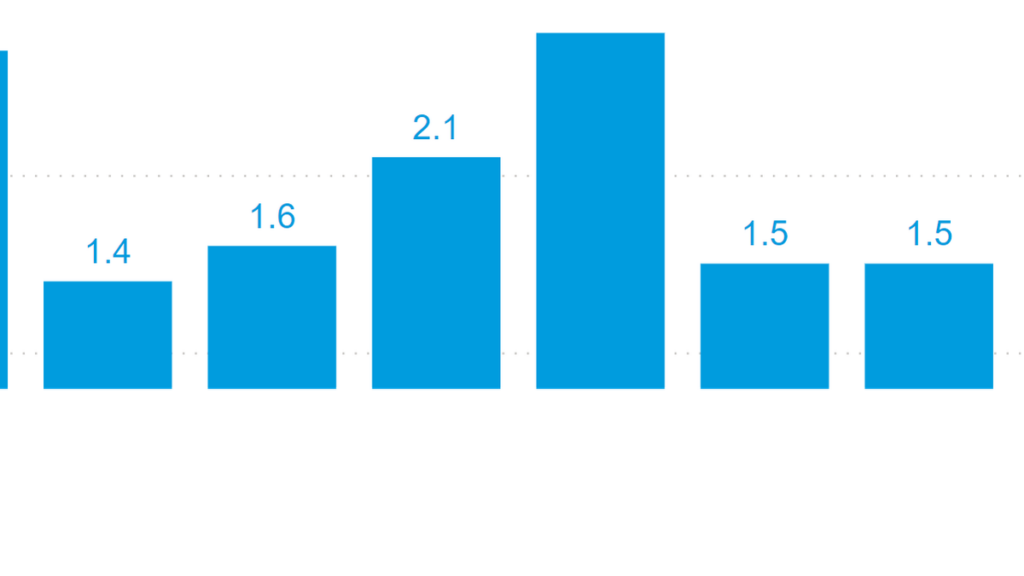

Productivity continues to rise in potential game changer for economy

The increase in productivity has most likely been a catalyst for both robust economic growth and disinflation over the past year.

Insourcing, outsourcing and co-sourcing: Which is right for you?

Insourcing, co-sourcing or outsourcing fund administration? Navigate the pros and cons, and find what suits your firm's journey.

What are the benefits of managed payroll?

Managed payroll, also known as payroll outsourcing, can decrease risk, increase accuracy, protect sensitive data and better support your business.

ASU 2023-09 will require enhanced disclosures about income taxes

Companies should prepare for a recent FASB update that requires enhanced disclosures about effective tax rates and income taxes paid.

Solving generation-skipping transfer tax problems

We delve into five common GST exemption allocation problems and provide suggested remedies to mitigate potential unintended consequences.

7 reasons to consider payroll outsourcing

Managed payroll, also known as payroll outsourcing, can decrease risk, increase accuracy, protect sensitive data and better support your business.

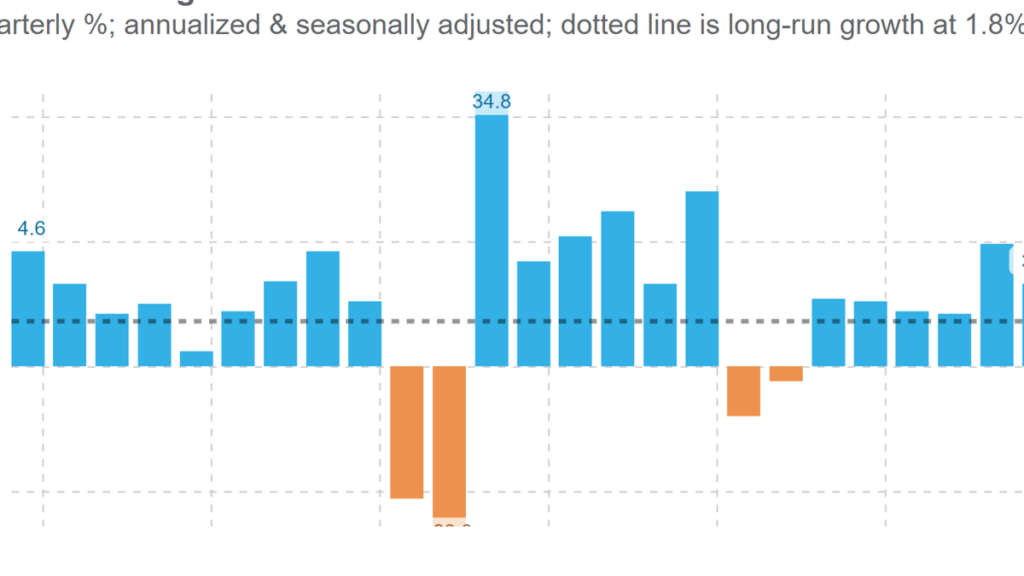

U.S. economy booms at a 3.3% pace in the fourth quarter

The U.S. economy last year expanded by a robust, above-trend pace of 3.1% and a fourth quarter pace on a seasonally adjusted rate of 3.3%.

The workers and workplaces of the future

How companies are adapting hiring practices and workforce strategies, given the shrinking U.S. labor force, according to the U.S. Chamber of Commerce.

Understanding the Backdoor Roth IRA

Are you a high-income earner seeking ways to optimize your retirement savings? Get a full grasp of how the Backdoor Roth IRA can be an effective tool for you.

Monday - Friday: 8:00 AM - 5:00 PM

*Friday hours are 8:00 AM – Noon between Memorial Day and Labor Day

Closed Saturday & Sunday

Subscribe to Our Newsletter

Johnson & Sheldon, PLLC

Amarillo Location

500 S Taylor St Suite 200

Amarillo, TX 79101

Phone: 806-371-7661

Fax: 806-371-0529

Email: ebaten@amacpas.com

Johnson & Sheldon, PLLC

Pampa Location

2004 N. Hobart

Pampa, TX 79065

Phone: 806-665-8429

Fax: 806-665-8804

Email: fbeavers@amacpas.com

Johnson & Sheldon, PLLC

Hereford Location

119 E 4th St

Hereford TX 79045

Phone: 806-364-4686

Fax: 806-364-0826

Email: khollingsworth@amacpas.com